Advantages of a Roth IRA

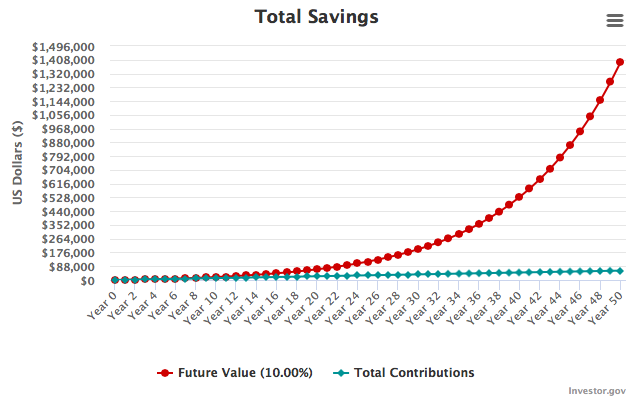

Pictured in this graphic is the idea of compound interest, and why it is advantageous to start investing early.

As the Halloween season approaches, so too do thoughts of the inevitability of death. And while retirement is not on most teenagers’ minds, one thing is for sure: you don’t want to be old and poor before you die. You can help mitigate the latter by investing a small sum of post-tax income monthly into a Roth IRA. A Roth IRA is a special type of retirement fund which allows for your contributions and earnings to grow indefinitely. With compounding interest, the more time the investment has to grow, the faster it grows and the richer you get. In fact, if you invest $100 dollars a month starting at age 16, by the time you are 66, you will have amassed nearly 1.5 million dollars, having only contributed $60,000 over the fifty-year period.

Most Boulder High Students have around 42-45 years until they reach retirement age; time is on our side. The graph assumes that one puts $100 per month into an S&P 500 index fund (a diverse, low-risk investment portfolio), which has historically grown by 10% per year. What is so special about a Roth IRA is that no capital gains taxes are paid; meaning that you can contribute post-tax income to the fund, and once that money (with the growth) has been extracted, you don’t have to pay a dime to the IRS. While planning this far in the future may seem like a waste of time, a small sustained contribution to a fund like this guarantees a comfortable financial future and may allay some of your fears of death.